Freelancing in Chicago – Part 1

This post is a bit outside the norm for my blog, but it is what has been on my mind a lot lately. I’ve entered the software development freelancing world, and with that comes all sorts of stuff you never think about when working for a company, whether big or small. Taxes come to mind, but even something as simple as what you can call yourself presents issues. This post and it’s followers will sum up some of what I’ve learned so far on my quest to become a sole proprietor and freelance software developer in Chicago, IL, USA.

Note: some, but not all of the content here is definitely specific to working as a United States taxpayer, so obviously it doesn’t apply everywhere. Be glad if you can skip over some of it because it doesn’t apply to you.

Time Tracking

One rather critical part of freelancing is earning some level of income. It is incredibly common in software development to bill at some hourly rate, so keeping track of time spent on projects is extremely important for both you and your clients.Another benefit of time tracking is less obvious at first glance- it allows you to see how much time you are being non-effective. I don’t want to say “wasting” as that is pretty harsh, but you’d be amazed at how much time can be spent on things that would probably be better spent on billable hours. Tracking this non-billable time is a great way to realize that even if you feel busy you could probably still take on more work.

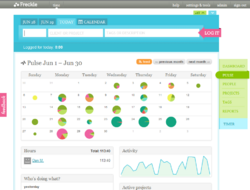

As far as tools go, there are many out there, but after a bit too much searching, I arrived at Freckle. It is super-cheap for someone working solo at just $12/month, and very effective at not requiring more input than strictly necessary to track time. I’ve found the UI very easy to work with and I’m motivated enough to enter my time as soon as I track it rather than having a stack of chicken-scratch post-its with times on my desk. The reporting is also pretty cool to get a visual overview of how you spend your time, and the invoicing is built-in, although it could use a little bit more love.

Contracts

Working under some sort of contract as a “Independent Contractor” (an IRS term) is a good way to make sure you and your client aren’t perceived to have an employee-employer relationship. If one or both of you are not in the USA or you are physically distant from each other this is probably not as big of a deal, but then the other benefits of a contract do come into play- your rate is established in writing, as are the expected deliverables. In addition, a written contract can have tons of other clauses establishing liability, warranties, whether parties are required and/or allowed to take each other to court.

Most of the time if a contract is involved, your client will probably have one for you to review rather than you having to draft one up. Obviously this means the contract might be tilted a bit more in their favor, so be sure to review it for any terms or conditions that might set off alarm bells. If there is something alarming, definitely ask the client for clarification and/or modifications to the contract- if they are unwilling then you might want to just walk away.

Every once in a while, you will get the opportunity to write the contract. I saw a recommendation to grab a copy of NOLO Resources – Consultant & Independent Contractor Agreements, and it definitely turned out to be a smart decision. If I am ever in a position to offer up a contract to a potential client, I have a great, well-researched version as a base. The book also has versions for both sides of the Independent Contractor and client relationship, so you can see exactly how getting to write the contract can turn a lot of things in your favor.

Registering an Assumed Business Name

In order to do business as anything but yourself (e.g. “John’s Smoothies” instead of “John Doe”), you need to register this assumed name you are doing business as. It usually involves registering with some unit of government, paying a fee, and publishing your intent to use that name as a way to do business.

In Chicago, you need to do the aforementioned registration with the Cook County Clerk. They have a surprisingly helpful page documenting the steps for Assumed Business Name Registration.

So what do you actually have to do to get registered? For those of you living in Chicago, you can follow these steps exactly, but for everyone else it will hopefully give you an idea of some of the hoops you may have to jump through.

- Grab the two necessary forms: the application and the legal notice to be published.

- Make sure you fill them out correctly. Make sure you use the exact same name everywhere, whether it be the assumed name or your name (obviously the two names will be different). This includes between the two forms. I can’t stress this enough as I messed something up only slightly (I forgot “Jr.” in one place) and had to jump through a lot of hoops to avoid re-filing and re-publishing and waiting another month and a half for everything to go through. Think twice about signing before you proceed to the next step- the notary may want to see you sign it in person.

- Get it notarized. I got lucky here because my former office manager is a public notary, but ask around and you will probably find someone that can help you out, otherwise currency exchanges are a good bet.

- Bring it in to the Cook County building downtown at 50 W. Washington, in the basement, to suite 114 (e.g. concourse level). They were surprisingly pleasant to work with, perhaps because my application was in good shape and had no problems. Bring $50 or a check for that amount.

- Now the not so fun part- you have to get it published in a paper. You have to do some digging yourself on this, but lucky for you I’ve done a fair amount and will share it with you. The Chicago Tribune and Chicago Sun-Times come to mind first, but be ready to pay for that privilege. The Tribune wanted $270 for the required three consecutive weekly publications.

- Be happy again when you realize a much better option is to contact the smaller but local Chicago Reader. Their rate, at $100, is much more in line with what I would expect, and they even do the work of mailing the county clerk directly with the proof of publication. Give them a call at 1 (312) 828-0350 and let them know you want to publish an Assumed Business Name notice, and they will be glad to help you out. My ad ran for three weeks in the printed paper and also showed up online.

- Wait for it to be published for three consecutive weeks and then be happy- you can officially operate under your assumed name!

That is it for Part 1, but I have at least one more post coming on a few more topics worth discussing. If there is anything you would like to hear more about, just ask and maybe a future blog post will come out of it.

Note: Part 2 is now available.

See Also

- My New Company - Simple Bit Labs - November 21, 2024

- No Thanks, PayPal - August 22, 2011

- Freelancing in Chicago – Part 2 - January 20, 2011

- Thanks for the second wishlist book - July 28, 2010

- LaTeX résumé Follow-up - May 10, 2010